Latest NEWS

- Aswat Masriya, the last word

- Roundup of Egypt's press headlines on March 15, 2017

- Roundup of Egypt's press headlines on March 14, 2017

- Former Egyptian President Hosni Mubarak to be released: lawyer

- Roundup of Egypt's press headlines on March 13, 2017

- Egypt's capital set to grow by half a million in 2017

- Egypt's wheat reserves to double with start of harvest -supply min

- Roundup of Egypt's press headlines on March 12, 2017

Tobacco boosts sales tax revenues to unprecedented level in last three years

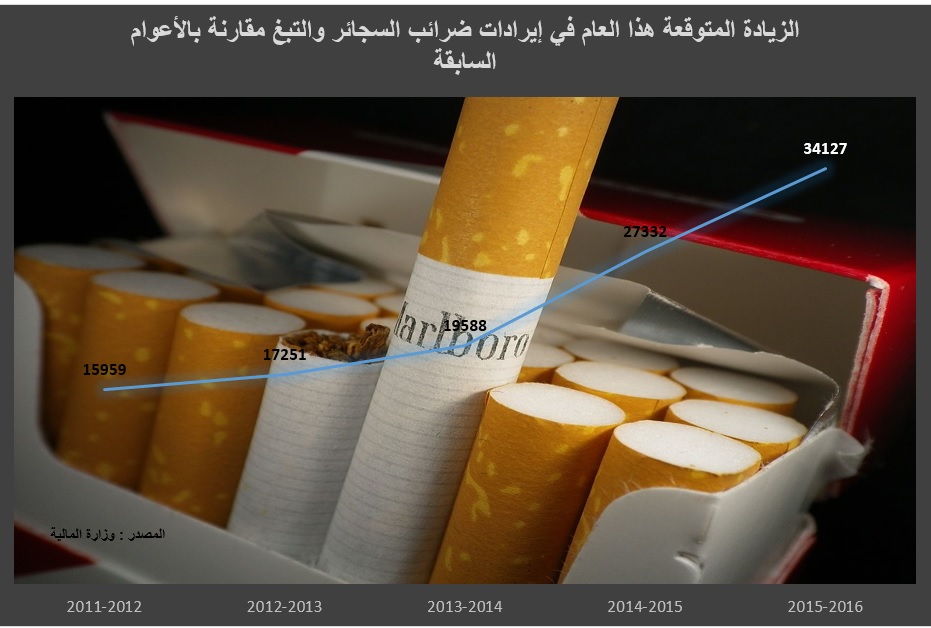

The expected hike this year in cigarette and tobacco tax revenues compared to previous years.

By Mohamed Gad

CAIRO, Oct. 21 (Aswat Masriya) - Proceeds from sales taxes and services in July and August 2015 have seen the highest growth rate recorded the past three years, according to the September financial report issued by the Ministry of Finance on Tuesday.

The growth rate hit 34.2 percent, equivilent to EGP 19.2 billion, which represents 53 percent of total tax revenue, according to the monthly report.

Mamdouh Omar, former head of the tax authority, attributed the increase to the sales tax that was imposed on cigarettes in the last fiscal year, which he said would naturally impact the income of the current year, especially since cigarettes make up a significant proportion of overall tax revenue.

The proceeds of cigarette taxes have grown by about 48 percent in July and August to reach EGP 4.9 billion, compared to the same months last year.

The government expects that the total proceeds from cigarette and tobacco taxes in the current fiscal year to reach EGP 34.1 billion, which represents about 21 percent of the gross proceeds from sales taxes.

Taxes on petroleum products have also risen by 234 percent to EGP 1.6 billion. Omar said that petroleum products have not been subject to an increase in sales tax, explaining that the growth reflects an increase in consumption.

He noted that petroleum products will contribute less in sales tax than cigarettes, forcasting about 6.3 percent in FY 2015-2016.

The financial monthly report recorded an increase of 19.2 percent in tax revenue, to reach EGP 2 billion, which indicates improvements in the tourism and telecommunications sectors.

The government expects domestic and international telecommunications services taxes to contribute about 4.6 percent to the total sales tax in 2015-2016.